CA SC-104 2009-2024 free printable template

Show details

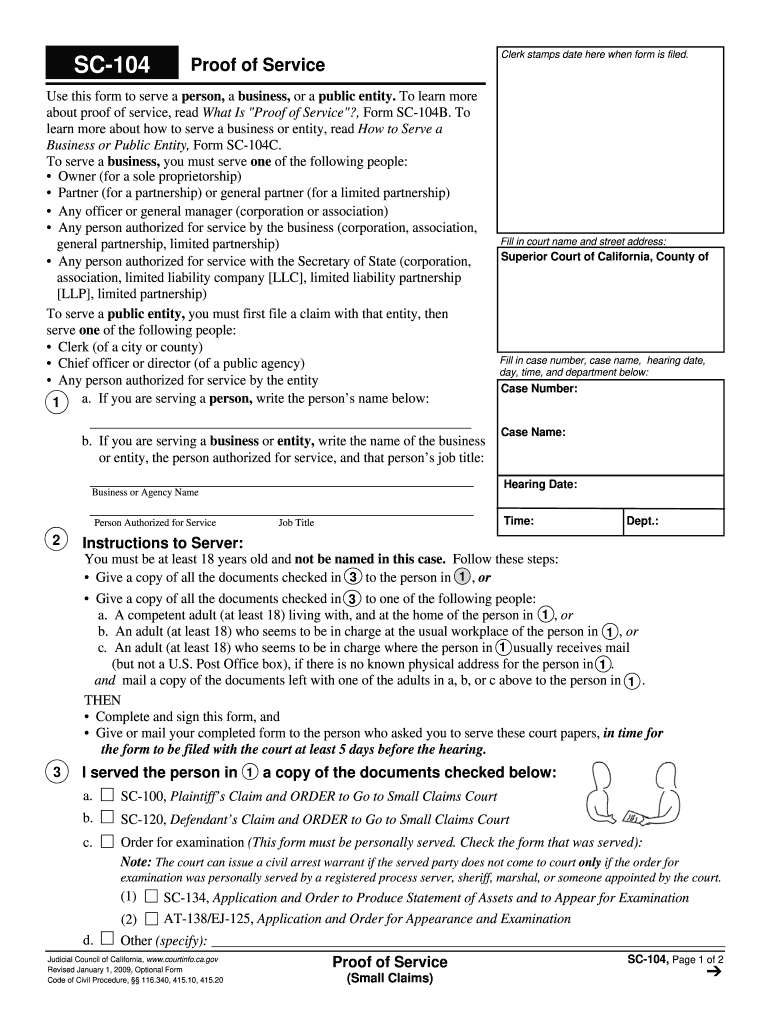

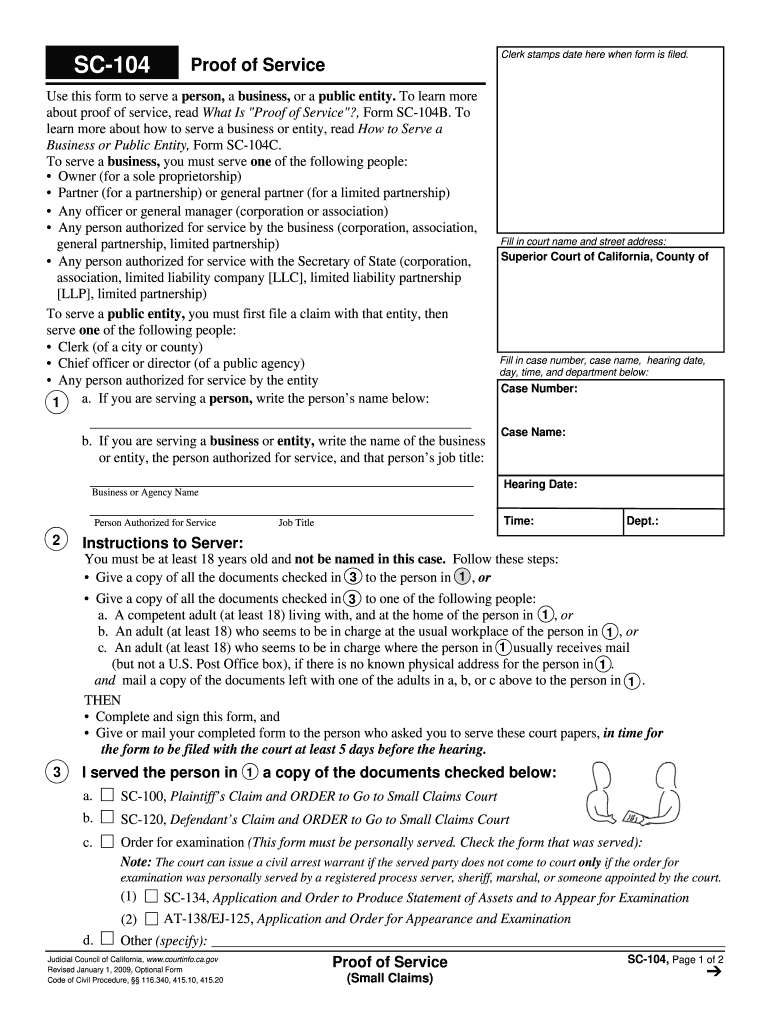

SC-104 Clerk stamps date here when form is filed. Proof of Service Use this form to serve a person a business or a public entity. To learn more about proof of service read What Is Proof of Service Form SC-104B. To learn more about how to serve a business or entity read How to Serve a Business or Public Entity Form SC-104C. 340 415. 10 415. 20 Small Claims SC-104 Page 1 of 2 Fill out a or b below Personal Service I personally gave copies of the documents checked in 3 to the person in 1 On date...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sc 104 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc 104 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sc 104 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form sc 104. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out sc 104 form

How to fill out SC 104:

01

Start by gathering all the necessary information and documents. This may include personal information, income details, deductions, and any supporting documentation.

02

Carefully read the instructions provided with the SC 104 form. It is essential to follow these instructions accurately to avoid making any mistakes.

03

Begin filling out the form by entering your personal information, such as your name, address, and Social Security number. Ensure that all the details are accurate and up-to-date.

04

Move on to the income section of the form. This is where you will list all your sources of income, including wages, dividends, rental income, self-employment earnings, etc. Be thorough and precise while reporting your income.

05

As you proceed, make sure to report any deductions you are eligible for. This may include expenses related to education, healthcare, mortgage interest, or charitable contributions. Refer to the appropriate sections and provide the necessary information for each deduction.

06

Double-check your math. The SC 104 form requires various calculations, such as calculating the total income, deductions, and tax owed. Make sure to review all your calculations for accuracy before moving to the next step.

07

Complete the remaining sections of the form, which may include information about dependents, tax credits, and any other pertinent details. Follow the instructions provided with each section to accurately provide the required information.

08

Once you have filled out all the necessary sections, carefully review the entire form. Look for any errors, omissions, or discrepancies. Correct any mistakes before finalizing the form.

09

Sign and date the form where indicated. Verify that all the required signatures are provided, including any joint filer or dependent signatures if applicable.

10

Make copies of the completed SC 104 form for your records and submit the original form to the appropriate tax authority, following the provided instructions.

Who needs SC 104:

01

Individuals who reside or earn income in the state that requires the SC 104 form.

02

Taxpayers who need to report their annual income, deductions, and other relevant financial information to the tax authorities.

03

Anyone who meets the filing requirements specified by the state for income tax purposes. These requirements may vary depending on factors such as income level, filing status, age, and residency status.

Fill sc 104 proof of service form : Try Risk Free

People Also Ask about sc 104

What is proof of Service California small claims?

What is a proof of Service SC 104 form?

What is an SC 100A form?

What is a SC 105 form?

What is a SC 104?

What is sc104?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sc 104?

SC 104 is a course offered at some universities that introduces students to the principles of computer science. Topics covered include programming, data structures, algorithms, computer architecture, operating systems, software engineering, and artificial intelligence.

Who is required to file sc 104?

All employers in Pennsylvania are required to file an Employer Withholding Tax Report (Form PA-W3) and the Employer Withholding Tax Reconciliation (Form PA-104) on an annual basis.

How to fill out sc 104?

To fill out SC 104, you will need to provide detailed information about the case. This form is used to provide information about the parties involved in the case, the court and the case number, the status of the case, the nature of the case, the hearing date, the time and place of the hearing, and any other relevant details.

What is the purpose of sc 104?

SC 104 is a course offered by many universities and colleges that focuses on the basic principles of computer science. It is designed to provide students with an introduction to the fundamentals of computing, including algorithms, data structures, computer architecture, programming languages, and operating systems. The course also covers topics such as software engineering, computer networking, and artificial intelligence.

When is the deadline to file sc 104 in 2023?

The deadline to file an SC 104 form in 2023 is April 15th.

What information must be reported on sc 104?

SC 104 is a Self-Employment Tax form filed by individuals who are self-employed and need to report their earnings and calculate their self-employment tax liability. The information that must be reported on this form includes:

1. Personal Information: This includes your name, address, Social Security Number, and any other identification numbers required by the IRS.

2. Business Information: You need to provide details about your business, such as the name, address, and employer identification number (EIN) if applicable.

3. Business Income: You must report the total income earned from your self-employment activities. This includes any cash, checks, or other forms of payment received from customers or clients.

4. Deductions: You can deduct certain expenses related to your self-employment activities, such as business supplies, equipment, and home office expenses. These expenses need to be reported separately on Schedule C.

5. Net Profit or Loss: After subtracting your deductible expenses from your business income, you will arrive at your net profit or loss. This figure is crucial for determining your self-employment tax liability.

6. Self-Employment Tax Calculation: Using the Schedule SE, you need to calculate your self-employment tax liability based on your net profit or loss. This tax is used to fund Social Security and Medicare.

7. Estimated Taxes: If you expect to owe more than $1,000 in self-employment tax for the year, you may need to make quarterly estimated tax payments. You must report the total amount of estimated tax payments made during the year.

8. Other Information: Depending on your specific circumstances, there may be additional information that needs to be reported on the SC 104 form, such as household employment taxes, uncollected Social Security and Medicare tax, or a credit for excess Social Security tax withheld.

It is important to consult the official IRS instructions for form SC 104 or seek professional tax advice to ensure accurate reporting and compliance with any changes or updates to the requirements.

What is the penalty for the late filing of sc 104?

The SC 104 is a form used for the late filing of the South Carolina Individual Income Tax Return. The penalty for late filing of SC 104 is generally 5% of the tax due per month, up to a maximum of 25% of the total tax due. This penalty is assessed for each month or part of a month that the return is late.

How can I modify sc 104 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including form sc 104, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send sc 104 proof of service for eSignature?

When you're ready to share your sc 104 pdf, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out form sc104 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your sc104 form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your sc 104 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc 104 Proof Of Service is not the form you're looking for?Search for another form here.

Keywords relevant to sc104 form

Related to sc 104 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.